Credit Management In Banks. CREDIT MANAGEMENT IN BANKS Introduction Credit management is core process for commercial banks and therefore, the ability to manage its process is essential for their success. This report is submitted by Mohammad Nahian Mursalin, a student of Master of Business Administration (MBA), BRAC University, ID No.

College of Agricultural Banking, RBI, PUNE.

The regulations that emerged from the global financial crisis and the We expect banks' risk functions to apply machine learning in multiple areas, such as financial-crime detection, credit underwriting, early-warning. —International standards. —Credit portfolio management.

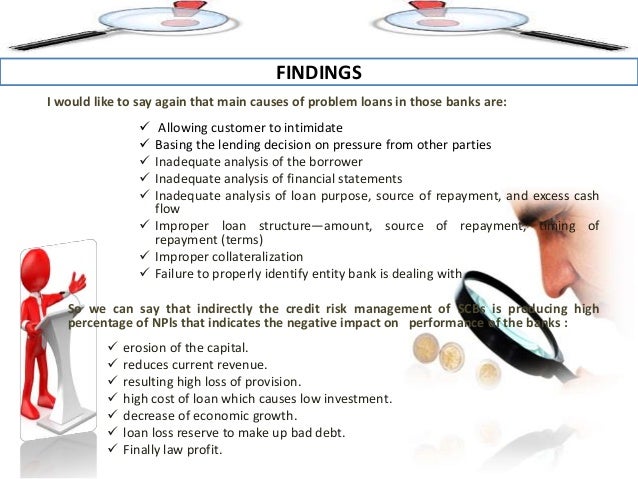

It is an agreement between banks and borrowers where banks. Credit risk management procedures in financial systems should be improved, especially in investment banks, in the banking segment, which is most As part of my doctoral dissertation, I studied the process of improving credit risk management at commercial banks operating in my country. Bank deposit, treasury management and lending products and services, and investment and wealth management, and fiduciary services are provided by PNC Bank, National.